How to fight your insurance company: Part One

The recent storms that passed through the southwest communities of Minneapolis left a trail of damage and confusion (as well as an incredible bloom of storm chasers). Not surprisingly, the aftermath of that storm has been interesting for a veteran of the industry to observe. From the almost comical circus of door-knocking contractors to the parade of under-qualified insurance adjusters flown in from all over the country, clients with damaged homes have been witness to the truly ugly result of the 8-6-13 storm.

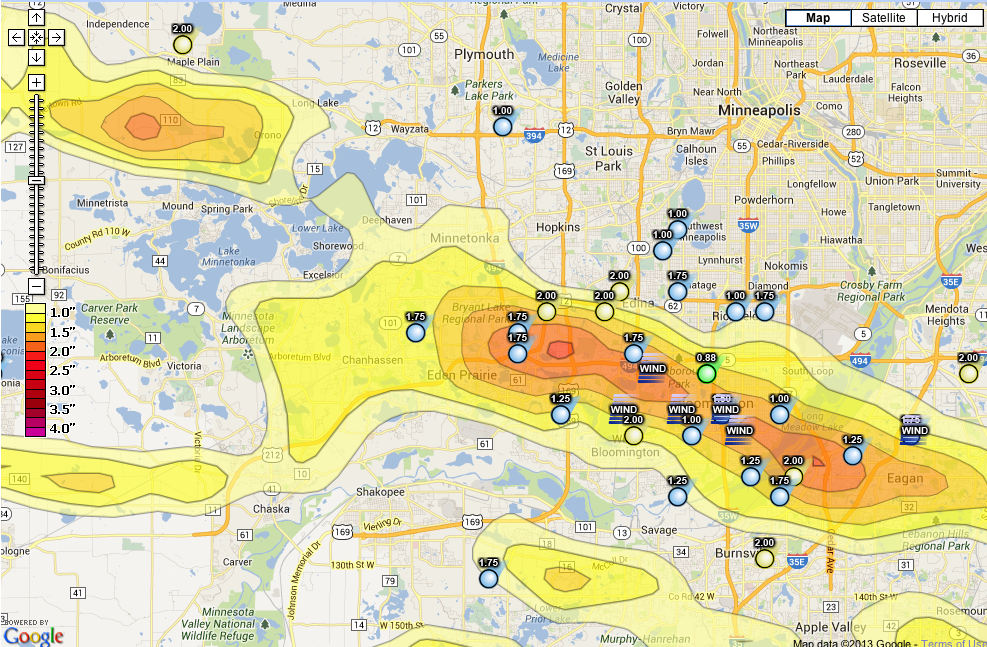

After having done good work for people for 25 years we don’t need to send guys to knock on doors (thank God). We’ve had a couple hundred former clients call us about inspecting their roofs after the storm pummeled their neighborhoods. Here is a hail map that you might find interesting.

This map shows hail distribution and intensity in the southwest communities of Minneapolis. This is what storm chasers use to target neighborhoods. They can zoom in for a street by street view of hail size as soon as a couple hours after the storm passes through. Pretty impressive and pretty expensive. At about $300 a pop these maps are generated by a variety of ‘Hail Watch’ services found online. Our main use for these maps is to let the guy in Golden Valley know the hail he heard about on the news didn’t touch his house. It saves us a lot of time in doing pointless inspections. But I digress.

I plan on doing a comprehensive study of the events that have occurred since this storm that focuses on how different insurance companies apply different standards to assessing and paying for the damage done to properties. As I frequently tell clients, the likelihood of getting a fair settlement from an insurance company has more to do with who you insure with and who walks up your driveway the day of the inspection than the objective reality of what occurred at their home. It’s true. I’ll say it again. When it comes to storm damage claims, what happened to your home during the storm isn’t as important as who you insure with and who your adjuster is. For example, if you insure with Chubb, ACE or Fireman’s Fund, you will most likely be treated quite well. If you insure through anyone you have seen advertising on TV you may have a fight on your hands.

My study will include specific case studies with high resolution photos of damage to homes. The differences in what All State, Farmers, State Farm, Travelers, Liberty Mutual, et cetera, cover as opposed to the aforementioned ‘good guys’ is truly shocking. Perhaps even more disturbing is the difference from one claim to the next under the same company. I was on two All State claims today. One was denied and the other was approved. Both had virtually identical damage.

Another example, I was at two Liberty Mutual adjuster meetings last week in Edina. They were in essentially the same neighborhood and both had hand-split medium 24″ cedar shake roofs of similar age and condition. Both involved hired consultants on the roof while the adjuster stood on the ground. I stood there on the roof watching as both of these ‘experts’ made their determinations. One consultant went hail dent crazy (lucky client), circling with chalk dozens of damaged shakes while the other didn’t circle a single piece with comparable damage (unlucky client). The first client is getting a new $30,000+ roof, the latter is getting zero. Same insurance company, vastly different outcomes. It’s hard to watch. (I’m in the process of helping client #2 fight the findings…more on that later).

Here are photos of damaged cedar shakes from my Liberty Mutual clients. One is from the ‘approved for replacement’ roof and the other from the roof that was denied. The subjectivity involved in this process would be depressing to people if they understood how prevalent it is.

Denied. This poor homeowner had an insurance adjuster apply arbitrary standards to his roof in Edina.

So, what can you do to increase the likelihood of being treated fairly after the storm? Number one, pay more for insurance and use Chubb, ACE or Fireman’s Fund. Number two, work with a company like ours to handle your claim from beginning to end. We employ a former insurance adjuster of 16 years on staff and if anyone knows how to get insurance companies to comply with reason it’s Pete.

More to follow soon on exactly how to best fight your insurance company if a claim doesn’t go your way.